Lump sum pension payout calculator

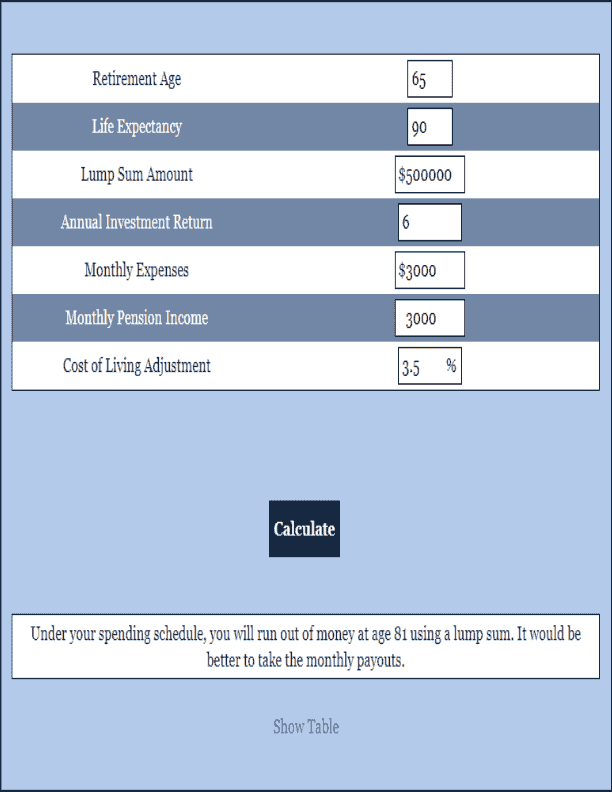

Pension VS Lump Sum Calculator. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Which Is Better A Lump Sum Pension Payout Or Monthly Payments Marshall Financial Group

Here is one approach I use when evaluating a clients pension offer.

. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. A simplified illustration.

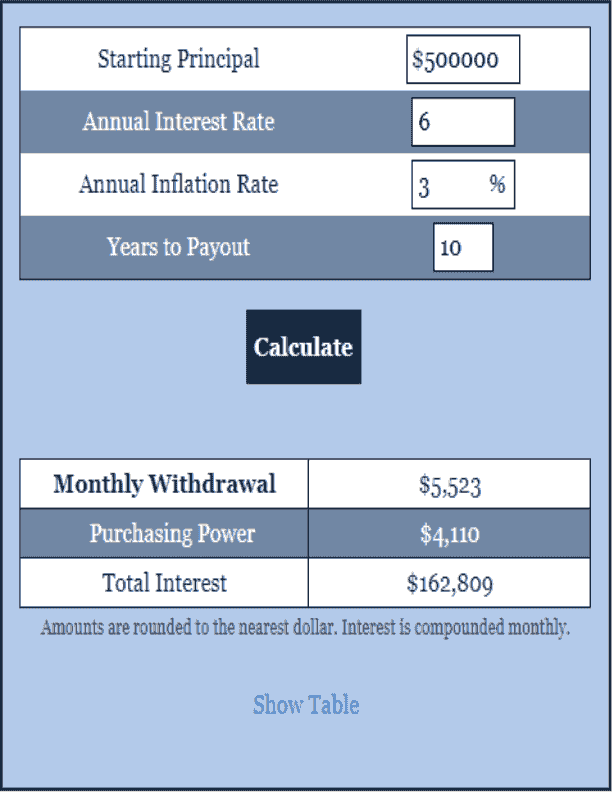

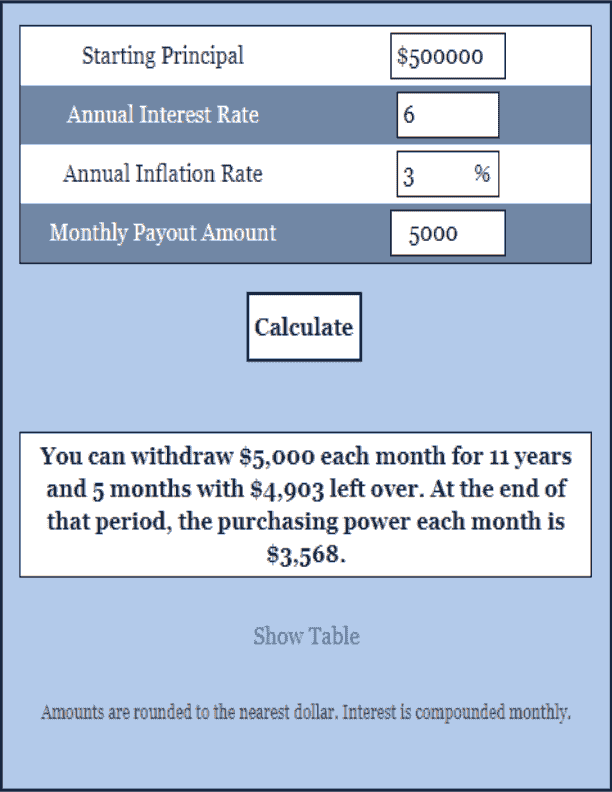

Should you consider a lump sum pension withdrawal for your 500K portfolio. A one-time payment for all or a portion of their pension. The Annuity Payout Calculator only calculates fixed payment or fixed length two of the most common options.

How to Avoid Taxes on a Lump Sum Pension Payout. Find out what the required annual. In the context of pensions the former is sometimes.

Both are represented by tabs on the calculator. When youre 55 or older you can. Employees often consider taking a lump sum pension payout for three common reasons.

Ad The Pension-vs-Lump-Sum Decision Leaves Retirees With a Conundrum. The IRR tells you. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Find out what the required annual rate of return required would be for. A typical multiplier is 2. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. So someone whod built up an annual state pension of.

Find out what the required annual rate of return required would be for. If you choose a lump-sum payout instead of monthly payments the responsibility for. Our lump sum vs.

We have the SARS tax rates tables. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

If you take a. Our Goal Is To Give You A More Logical Personal Way To Invest Manage Your Money. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

Receiving a lump sum. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. Calculate future value and future value interest factor FVIF for a present lump sum annuity growing annuity or investment.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. How do I calculate my pension payout. Ad From Life Retirement Planning To Investing Our Free Calculators Are Here To Help.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Why Take a Lump Sum Pension Payout. Retirees Often Face a Tough Decision.

And The Right Choice May Not Be Obvious. So if you work 30 years and your final average salary is 75000 then your pension would be 30 x 2 x 75000 45000 a. Find out what the required annual rate of return required would be for.

Ad Learn how a lump sum pension withdrawal may give you more income flexibility. Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353. With continuous compounding and perpetuity.

Try the free Pension vs. Start by calculating the internal rate of return IRR of the pension. Annuity payment calculator compares two payment options.

A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for example. This is known as a lump-sum payout option. Find out what the required annual rate of return required would be for.

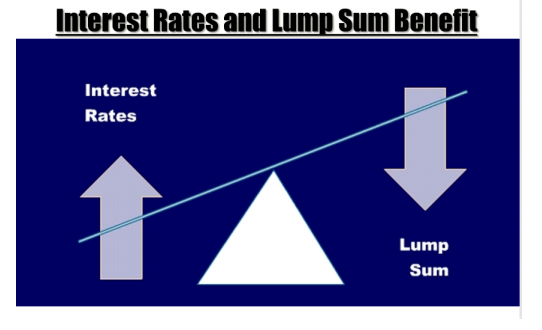

You have access to the cash you. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated.

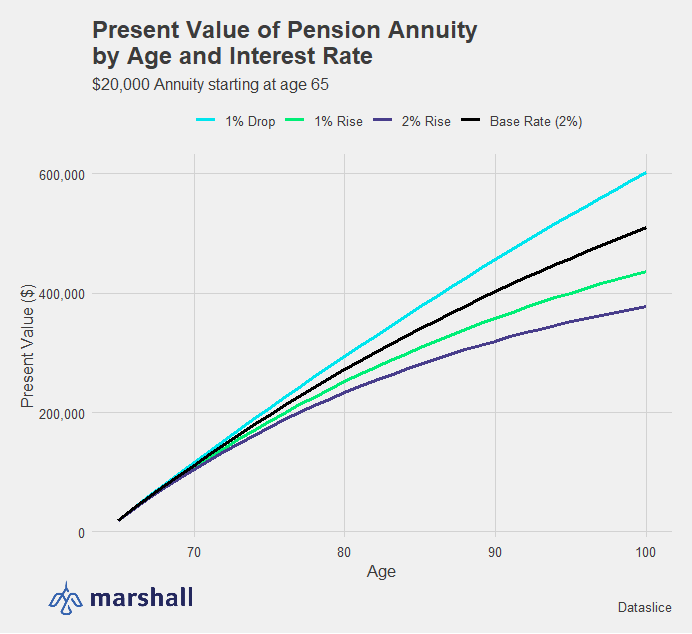

Present Value Of An Annuity How To Calculate Examples

Retirement Calculator Choose A Retirement Calculator

Pension Calculator Retirement Pension Plan Calculator Online

Present Value Of An Annuity Calculator Date Flexibility

When Can You Cash Out An Annuity Getting Money From An Annuity

How Retirees Can Avoid Taxes On Lump Sum Pension Payouts

Lump Sum Payments May Have Peaked With Conocophillips Due To Rising Interest Rates

How Retirees Can Avoid Taxes On Lump Sum Pension Payouts

How Much Is My Pension Worth Money Gremlin

Sbi Annuity Deposit Scheme Calculator For Monthly Pension Payout Youtube

How Retirees Can Avoid Taxes On Lump Sum Pension Payouts

Retirement Calculator Choose A Retirement Calculator

When Can You Cash Out An Annuity Getting Money From An Annuity

Pension Payouts Lump Sum Payout Vs Monthly Payments Frontier Wealth Management

How Much Monthly Pension Can I Get From Nps Kfin Technologies Private Limited Kfintech

Retirement Calculator Choose A Retirement Calculator

Lump Sum Disability Buyout Calculator Ortiz Law Firm National Disability Attorneys